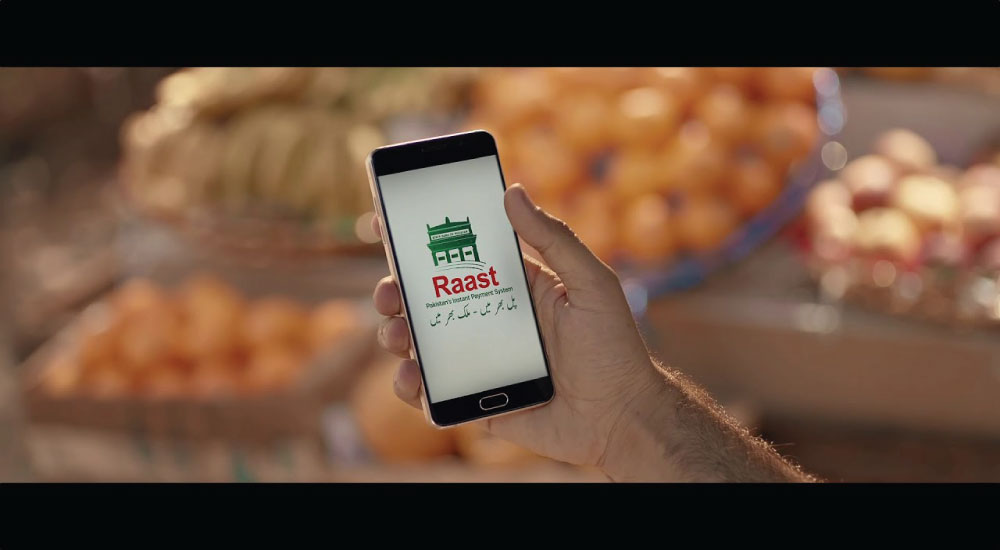

What Will ‘Raast’ Do For Pakistan’s Cashless Economy?

The state-of-the-art faster payment system can be used to settle small-value retail payments in real-time while also providing cheap and universal access to all players in the financial industry, including banks and fintechs. This will serve as a direct connection between users located anywhere.

While various private-sector digital cash transfer systems exist in the country such as Jazz Cash, Zong Easy Paisa, etc, this is the first system that links government entities and financial institutions. The government reiterated that the automated collection of taxes on transactions and tightened rules on banking will help shift the country away from a cash economy and tackle corruption more efficiently, under an extensive policy framework of Digital Pakistan Vision.

Apart from this, this move is aimed to boost the formal economy, increase the financial inclusion of women, and reduce poverty in the country. This platform will increase the outreach of the Ehsaas Programme and Benazir Income Support Program to the economically isolated classes, especially women. Through this, women in rural areas can open their bank accounts and receive any cash payments from the government directly to improve their livelihoods.

As per a new MoU between the central bank and Controller General of Accounts (CGAP), the government will now be disbursing salaries and pensions of a group of Federal Government employees through Raast. Also, as per government statistics, the volume of mobile banking transactions has reached PKR 1.12 trillion, witnessing an increase of 147%, during the second quarter of 2020-2021. Moreover, registered phone users have also increased by 5% during this period.