Purchasing property, whether it is for a residential home, a business place, or an investment, is always a large accomplishment. But unlike entitlement, property ownership is not without its pains which mainly manifest in acquiring the finances to buy the house. This therefore means that today’s real estate market has flexibility in in financing, which may help you to pay as you go and get what you want. This blog seeks to examine some of the most efficient option of source of finance likely to be received by prospective property buyers.

House Financing- What does it Means:

House financing is an essential resource that aims at enabling individuals to raise funds that will enable them to achieve their dream of owning a house, despite the various challenges that may hinder the process. It acts as a source of funds to finance the acquisition of new homes or the upgrade of existing ones, stock, or the construction of new ones to help those who cannot afford to make cash down payments, and/or pay a lump sum for a house, through a mortgage plan.

Home ownership financed by mortgage can be concluded when understood and properly managed. It has a role in creating a foundation and establishing a stable existence in a place; therefore making it an important factor why one should own a house.

Available House Finance In Pakistan:

In the housing finance market of Pakistan, candidates are free to select either a conventional house finance structure or an Islamic house finance structure which is equipped with different frameworks and incentives. On the basis of interest, conventional finance means a specific sum that can be borrowed with an extra fee that may differ. This is flexible with its mode of loan repayment and tenure, which is why so many people choose this option.

Islamic house finance, on the other hand, is based on Shariah law and does not utilize or accept any interest. Unlike conventional modes like interest-based contracts where a fixed amount is charged for the loan, Islamic banking employs Murabaha (mark-up financing) or Ijarah (leasing) where the bank directly buys the property and then sells it to the borrower at an agreed profit margin or leases it to the borrower. It is ethically acceptable by many people in Pakistan, and is considered acceptable by most in the religious world, therefore is a better approach than the conventional approaches in financing.

Each of them is useful in different settings and each has its merits and demerits. In terms of expense and consistency in the monthly installments, conventional finance might be better off with relatively low start-up fees that are standard and more fixed arrangements; however, it does not fulfill the requirements of Islamic law, and therefore is not suitable for practicing Shariah clients. While Islamic finance may be religiously suitable to the community and workers, it may be slightly costly at the beginning especially when one is getting used to it since the terms of the agreement might be complex and different. It is, therefore, important for borrowers to grasp these differences so that they can identify the most appropriate one to meet their requirement in terms of financing and ethical standards.

Whether you’re a first-time homebuyer or looking to refinance your existing mortgage, here’s a rundown of some of the top banks providing home financing solutions in Pakistan.

- Habib Bank Limited (HBL)

Overview: Habib Bank Limited, one of Pakistan’s largest and oldest banks, provides a range of home financing options. HBL’s home loans are designed to cater to various financial needs, including purchasing, constructing, or renovating homes. With the HBL Home Loan, you can secure a loan ranging from Rs. 2 million to Rs. 15 million, with repayment terms extending from 60 to 240 months. HBL provides a loan calculator on their website to help you determine the potential loan amount.

Eligibility: To qualify for an HBL Home Loan, you must have a minimum monthly salary of Rs. 100,000 and be between 22 and 60 years old. Required documentation includes your CNIC, salary slips, a 12-month bank statement, proof of at least 5 years of experience, Pakistani nationality (either resident or non-resident), and an employer’s letter.

- National Bank of Pakistan (NBP)

Overview: The National Bank of Pakistan offers comprehensive home financing solutions designed to make home ownership more accessible. NBP’s home loan products are known for their attractive terms and customer-centric approach.

The National Bank of Pakistan (NBP) offers home loans with favorable terms through its Saibaan program. This program supports both construction and purchase loans, with a maximum loan amount of up to Rs. 35 million and terms ranging from 3 to 20 years. NBP is known for its competitive rates due to its variable annual return policy.

Eligibility:

- Minimum age: 22 years.

- Net income: Rs. 10,000 for government employees; Rs. 15,000 for private sector employees.

- United Bank Limited (UBL)

Overview: United Bank Limited provides diverse home financing options, including loans for purchasing, constructing, and renovating homes. UBL is known for its customer-friendly services and flexible financing solutions. You can apply for a loan starting from Rs. 1 million, with repayment terms ranging from 36 to 240 months.

Eligibility:

- Minimum monthly income: Rs. 50,000.

- Age: 23 to 65 years.

- Required documents: CNIC, salary slips, a 12-month bank statement, proof of Pakistani residency, and evidence of 12 years of employment.

- Standard Chartered Bank

Overview: Standard Chartered Bank offers tailored home financing solutions designed for both individuals and families. Their home loans come with flexible terms and competitive rates. he Saadiq Home Financing division of Standard Chartered Bank offers loans ranging from Rs. 3 million to Rs. 30 million, with repayment terms of 12 to 240 months. Like HBL, Standard Chartered provides an online loan calculator to assist with loan planning.

Eligibility:

- Up to 75% of the property’s value.

- Minimum Salary: Rs. 50,000.

- Age Range: 21 to 60 years.

- Required Documents: CNIC, salary slips, a 12-month bank statement, and a letter from your employer.

- Faysal Bank

Overview: Faysal Bank offers a range of home financing products aimed at making home ownership more attainable. Their loans are suitable for purchasing, constructing, or renovating homes. Faysal Bank’s home loan program operates on the diminishing Musharakah principle. In this arrangement, both the bank and the customer jointly purchase the property, with the bank renting out its share to the customer. As the customer makes payments, ownership of the property gradually transfers to them until they become the sole owner.

Eligibility:

- Citizenship: Must be a Pakistani citizen.

- Minimum Income: Rs. 100,000 for salaried individuals.

- Age Range: 21 to 60 years.

How to Process?

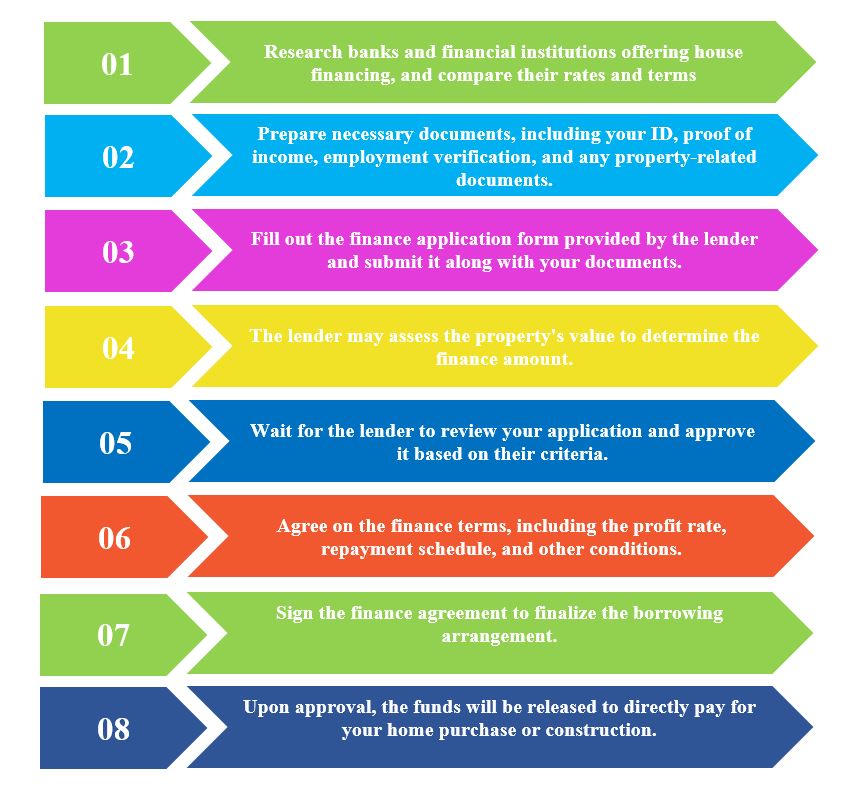

Starting the process of getting housing finance in Pakistan requires not only formulation of a sound strategy, but also some basic insights into the practical realities of the application process. To make your application smooth and without any hitches, this guide is developed to help you through each phase, and given relevant information as to what to expect, documents required and what you need to do after. This practical guide outlines the appropriate measures that can help you simplify the process of applying for a home and start the journey toward home ownership.